Moderators: richierich, ua900, PanAm_DC10, hOMSaR

-

-

atcsundevil

Moderator

- Posts: 6130

- Joined:

JetBlue/Spirit Merger Discussion Thread - 2022

Now that the merger has been officially announced, this thread will serve as a general discussion thread for updates throughout the process.

Please reference the previous discussion: viewtopic.php?f=3&t=1472927

✈️ atcsundevil

Please reference the previous discussion: viewtopic.php?f=3&t=1472927

✈️ atcsundevil

-

- DenverBrian

- Posts: 30

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

I see "merger" but this sure seems to be an acquisition. I doubt we'll see the Spirit name in three years.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

In an ideal world, they’ll deny this one. But they won’t.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

DenverBrian wrote:I see "merger" but this sure seems to be an acquisition. I doubt we'll see the Spirit name in three years.

All mergers are acquisitions and in this one, B6 has made it clear that it’s a complete takeover.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

Given the divestiture precedent in all mergers, I fail to see DOJ not requiring northeast divestitures, especially in LGA, despite for the most part any NEA denial. If NEA is denied it would't necessarily be because of the merger. DOJ can find some other underlying malfunction with it which it then will have no bearing on any B6/NK case to keep all their merged slots.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

I wouldn’t be surprised to see B6 change their business model to be more in line with the current ULCC model.

Also, not sure how this answers B6’s smaller presence on the west coast. LAX and LAS will be good sized bases but other than that this hasn’t helped them out west.

Also, not sure how this answers B6’s smaller presence on the west coast. LAX and LAS will be good sized bases but other than that this hasn’t helped them out west.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

This was an interesting development. I’m curious if JetBlue will move their headquarters to Florida with this merger?

Re: JetBlue/Spirit Merger Discussion Thread - 2022

sea13 wrote:I wouldn’t be surprised to see B6 change their business model to be more in line with the current ULCC model.

Also, not sure how this answers B6’s smaller presence on the west coast. LAX and LAS will be good sized bases but other than that this hasn’t helped them out west.

Who knows? But B6 has made its reputation based on a quality product. NK has theirs on price. I think value trumps price here

Re: JetBlue/Spirit Merger Discussion Thread - 2022

More incoming a-la-cart options at JetBlue. This airline needs to make up its mind on what it wants to be. An east-coast premium-ish alternative with Europe service or shuttling people along the Hebrew highway and into the Caribbean for the lowest cost possible.

Either way, Frontier is licking their lips.

I think they've said that they've committed to keeping it in NYC...but that doesn't mean 5-10 years from now they could move, or move/keep a substantial staff in FL. Spirit does have some nice digs in Miramar.

Either way, Frontier is licking their lips.

Oykie wrote:This was an interesting development. I’m curious if JetBlue will move their headquarters to Florida with this merger?

I think they've said that they've committed to keeping it in NYC...but that doesn't mean 5-10 years from now they could move, or move/keep a substantial staff in FL. Spirit does have some nice digs in Miramar.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

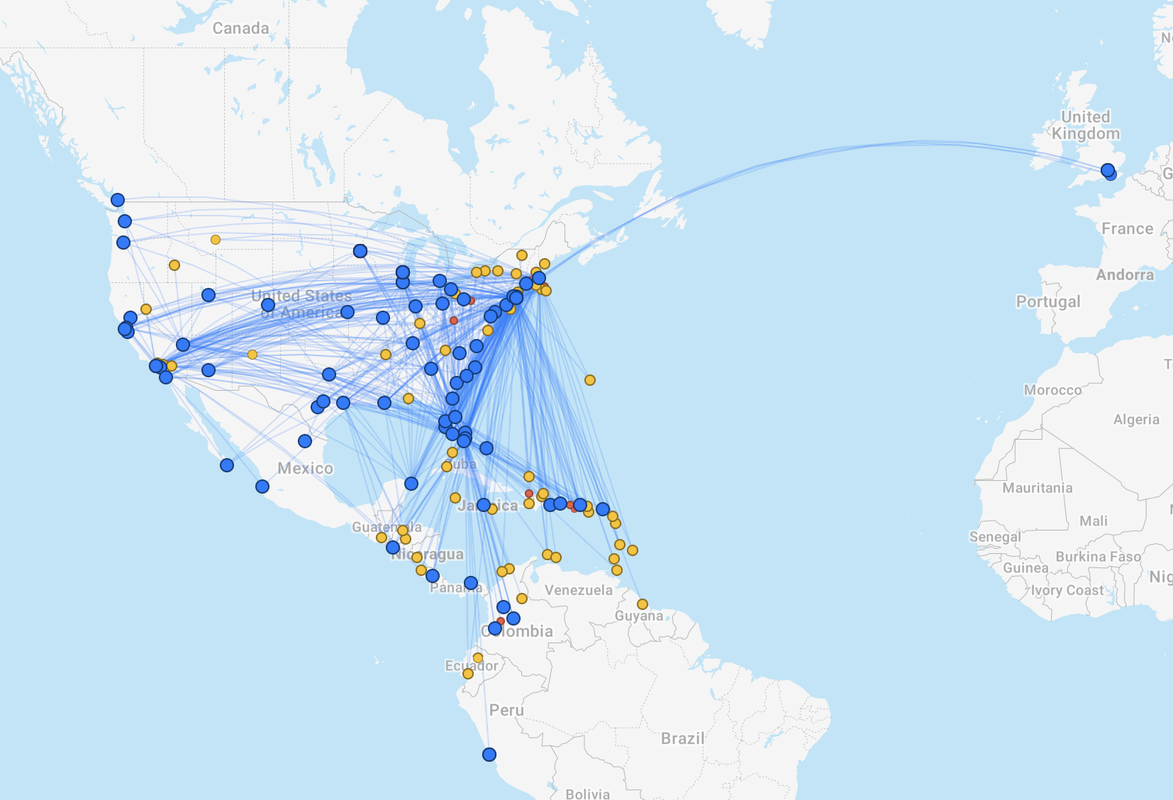

Does anyone have a combined route map?

Re: JetBlue/Spirit Merger Discussion Thread - 2022

I live in CMH and we have spirit. I wonder what the future has in store for JetBlue at CMH, since FLL and MCO are focus cities for JetBllue I could see them keeping those routes

but they would be competing with Southwest,or possibility of JFK again. We had JetBlue in the late 2000s they didnt last long.

but they would be competing with Southwest,or possibility of JFK again. We had JetBlue in the late 2000s they didnt last long.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

Good morning, this kills the NEA model with AA also. B6 also must convince the politicians to approve this, to pressure the the DOT and DOJ. I wouldn't be surprise that B6 also makes some olive branch to AA to calm their protests that I'm sure will come.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

doulasc wrote:I live in CMH and we have spirit. I wonder what the future has in store for JetBlue at CMH, since FLL and MCO are focus cities for JetBllue I could see them keeping those routes

but they would be competing with Southwest,or possibility of JFK again. We had JetBlue in the late 2000s they didnt last long.

I think many NK cities and routes are in jeopardy of losing service with the B6 takeover. I've read one of the big reasons B6 wanted NK is for pilots and aircraft. Bye bye yellow bus.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

mikejepp wrote:Does anyone have a combined route map?

There is a map of destinations on the merger site, but it doesn't show routes:

https://lowfaresgreatservice.com

-

- FlyingSicilian

- Posts: 2470

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

Spirit just announced an IAH crew base after opening a MX base. Would be great to keep the pressure on UA but I doubt jetBlue can handle it. Time will tell.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

AAguy1992 wrote:Good morning, this kills the NEA model with AA also. B6 also must convince the politicians to approve this, to pressure the the DOT and DOJ. I wouldn't be surprise that B6 also makes some olive branch to AA to calm their protests that I'm sure will come.

I don’t see how NEA survives. B6 argues that eliminating a competitor and combining with NK makes them #5 and a viable competitor against #1 - #4. Then B6 wants to join forces with #1 (AA) with the authorization granted by the previous administration to coordinate schedules, equipment gauge, and revenue share. Some have asked in other threads how this is different than the former AS/DL codeshare. It differs because in this case, a previous administration granted an unprecedented level of cooperation between two airlines on domestic routes.

See this write up from the DOJ:

https://www.justice.gov/opa/pr/justice- ... rlines-and

I can’t see AA being very happy about this. While I wish this could be true (I’m a DFW based AA frequent flyer so the NEA would benefit me when traveling to the northeast) I don’t see how BOTH the merger AND NEA pass DOJ muster and I don’t see B6 faring well in court.

Last edited by 385441 on Thu Jul 28, 2022 7:21 pm, edited 2 times in total.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

TYWoolman wrote:Given the divestiture precedent in all mergers, I fail to see DOJ not requiring northeast divestitures, especially in LGA, despite for the most part any NEA denial. If NEA is denied it would't necessarily be because of the merger. DOJ can find some other underlying malfunction with it which it then will have no bearing on any B6/NK case to keep all their merged slots.

Why? Even aa/nk/b6 lga combined slots would be smaller than delta’s portfolio.

What would be the competitive or consumer benefit of allowing delta greater relative pricing power?

I can see giving some to F9 as a check but it should be balanced against just giving delta a relatively larger pricing power in lga.

Does anyone recall. Did NK get any lga slots ultimately from the aa/us merger or was that primarily WN?

Last edited by dfwfanboy on Thu Jul 28, 2022 7:14 pm, edited 1 time in total.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

When would merger close and soc come around

Re: JetBlue/Spirit Merger Discussion Thread - 2022

dfwfanboy wrote:TYWoolman wrote:Given the divestiture precedent in all mergers, I fail to see DOJ not requiring northeast divestitures, especially in LGA, despite for the most part any NEA denial. If NEA is denied it would't necessarily be because of the merger. DOJ can find some other underlying malfunction with it which it then will have no bearing on any B6/NK case to keep all their merged slots.

Why? Even aa/nk/b6 lga combined slots would be smaller than delta’s portfolio.

What would be the competitive or consumer benefit of allowing delta greater relative pricing power?

I can see giving some to F9 as a check but it should be balanced against just giving delta a relatively larger pricing power in lga.

Does anyone recall. Did NK get any lga slots ultimately from the aa/us merger or was that primarily WN?

DOJ has always jumped on the opportunity to add additional ULCC/LCC for merger deals. That's why my reasoning on that. Would it be enough that B6 is an LCC? Maybe. I don't know. But they are taking out a ULCC model industry-wide and the compromise I think will be divestitures in highly concentrated areas. ULCC carriers will be flexing their feathers to the DOJ about that. Would be difficult to ignore. Yes there is precedent for mergers. But that precedent is always with divestitures to the underdog. B6/NK are concentrating their pricing power at the same time. Delta's pricing power "share" relative to however the remaining share is split remains the same (If my logic is correct). What say you?

Also - pretty sure it was all SWA that divestments went to on AA/US merger.

Last edited by TYWoolman on Thu Jul 28, 2022 7:39 pm, edited 1 time in total.

-

- asteriskceo

- Posts: 533

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

mikejepp wrote:Does anyone have a combined route map?

Dot colors represent airport size, not airline.

Last edited by asteriskceo on Thu Jul 28, 2022 7:42 pm, edited 1 time in total.

-

- AmericanAir88

- Posts: 395

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

dtremit wrote:mikejepp wrote:Does anyone have a combined route map?

There is a map of destinations on the merger site, but it doesn't show routes:

https://lowfaresgreatservice.com

83 departures out of LAS for B6. Wow.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

AMALH747430 wrote:I can’t see AA being very happy about this. While I wish this could be true (I’m a DFW based AA frequent flyer so the NEA would benefit me when traveling to the northeast) I don’t see how BOTH the merger AND NEA pass DOJ muster and I don’t see B6 faring well in court.

I'm sure they have already talked plenty with AA leadership, but in the abstract, I suspect AA is glad to see F9+NK off the table no matter what happens to the NEA. A combined F9+NK would have been a thorn in their side in Dallas and Chicago, in a way that B6 probably won't be. Even absent the NEA, I think B6's expansion is likely to run more directly into DL and UA more than AA.

That said, at least in theory the NEA and merger questions will be considered separately — AA and B6 have a court date in September for the DOJ suit, and they project the merger closing "no later than the first half of 2024." I'm not sure whether the court can give much weight to the theoretical merger in their analysis of the NEA; it would be hard to undo an existing codeshare arrangement on the basis of a merger that hasn't yet occurred.

If the NEA passes court scrutiny, it would leave B6 in a better position to negotiate on the subsequent merger — perhaps paving a way for a reduced NEA instead of outright elimination.

-

- FlyinRabbit88

- Posts: 312

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

Brianpr3 wrote:When would merger close and soc come around

Just taking the last merger timeline (Alaska - Virgin America) as a base timeline (since B6/NK will probably be longer with the NEA lawsuit and any other DOJ hurdles)

AS/VX took about 8 months to close with the DOJ. Expect at least a year (jetblue has a 12/2023 incentive to close deal by)

But as for a pilot group (and even other work groups) integration it could be a lot a few years before everything is settled and new contracts are finalized.

04/04/2016 - Alaska / Virgin America merger announced

All new hires at both companies post this date were placed on the SLI by DOH.

12/2016 - Merger closes with DOJ

This date was later used as the “snapshot date” for “analysis of the respective pre-merger equities.”

12/2016 - TPA agreement between all parties

11/2017 - Joint CBA reached

07/25/2017 - Stipulations agreement for SLI

01/2018 - SLI mediation (which of course never produces an agreement)

04-05/2018 - SLI arbitration hearings

07/2018 - Final SLI briefs

10/2018 - SLI award

Re: JetBlue/Spirit Merger Discussion Thread - 2022

With the combined fleets and current orders will they become the worlds largest A320 family operator? Are any A320s slated for retirements?

Actually now that I think about it, including the A220s, will they be the worlds largest overall Airbus operator? I count almost 700 A220/319/320/321s in service and on order.

Actually now that I think about it, including the A220s, will they be the worlds largest overall Airbus operator? I count almost 700 A220/319/320/321s in service and on order.

-

- NameOmitted

- Posts: 1433

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

After what AS paid in a bidding war for VX, I'm guessing there are a few smiles in SeaTac over the $1B premium B6 paid.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

FlyinRabbit88 wrote:But as for a pilot group (and even other work groups) integration it could be a lot a few years before everything is settled and new contracts are finalized.

You''re probably right that AS/VX is the likely precedent for a labor timeline — but I think it's optimistic in terms of the overall timeline for integration of the two brands. The last VX branded flight operated in April of 2018, before seniority integration was complete.

I suspect in terms of the actual integration of the two airlines, the WN/FL merger is likely to be the more comparable model, with a slow phaseout of NK flights by route/city. I doubt JetBlue is going to want to fly NK-configured aircraft under its brand, and I have a feeling they're going to face similar issues with systems integrations since B6's IT is already a complete disaster.

-

- NameOmitted

- Posts: 1433

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

dtremit wrote:FlyinRabbit88 wrote:But as for a pilot group (and even other work groups) integration it could be a lot a few years before everything is settled and new contracts are finalized.

You''re probably right that AS/VX is the likely precedent for a labor timeline — but I think it's optimistic in terms of the overall timeline for integration of the two brands. The last VX branded flight operated in April of 2018, before seniority integration was complete.

I suspect in terms of the actual integration of the two airlines, the WN/FL merger is likely to be the more comparable model, with a slow phaseout of NK flights by route/city. I doubt JetBlue is going to want to fly NK-configured aircraft under its brand, and I have a feeling they're going to face similar issues with systems integrations since B6's IT is already a complete disaster.

It's also worth remembering that Alaska did not purchase the Virgin brand and was paying a licensing fee for as long as they were operating Virgin branded aircraft. There was an economic incentive to change the outside of the aircraft on a different timeframe from the interior, which JetBlue won't have.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

mikejepp wrote:With the combined fleets and current orders will they become the worlds largest A320 family operator? Are any A320s slated for retirements?

Actually now that I think about it, including the A220s, will they be the worlds largest overall Airbus operator? I count almost 700 A220/319/320/321s in service and on order.

I would believe it would be one of the biggest if not thee biggest. According to Wikipedia Spirit has A319neo on order. I wonder what will happen to that order as JetBlue has the A220. If my counting is right they will have 394 airbus A320 series Airplanes in fleet and 209 on order.

-

- BlueBaller

- Posts: 256

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

NameOmitted wrote:After what AS paid in a bidding war for VX, I'm guessing there are a few smiles in SeaTac over the $1B premium B6 paid.

Correct me if I’m wrong but ALK paid 4B in 2016 dollars compared to JBUs 3.8 in today’s. Where’s the premium? Not to mention ALK is about to become extremely vulnerable due to their current network which focuses on transcons and regional strongholds, which is exactly what JetBlue is working to get away from with the acquisition.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

NameOmitted wrote:After what AS paid in a bidding war for VX, I'm guessing there are a few smiles in SeaTac over the $1B premium B6 paid.

I don't think you can quite say that. B6 valued and structure the deal with NK differently than F9. I wouldn't say that F9 made B6 pay 1 billion more.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

mikejepp wrote:With the combined fleets and current orders will they become the worlds largest A320 family operator? Are any A320s slated for retirements?

Actually now that I think about it, including the A220s, will they be the worlds largest overall Airbus operator? I count almost 700 A220/319/320/321s in service and on order.

I think AA still beats them in terms of A320s currently operating — 452 vs 405 (225+180). With all current orders delivered (on both sides), the combined B6+NK would leapfrog them, I think (582 vs 514).

If 6E takes all their orders, they'll be the largest A320 family operator with 805 planes (267 today + 538 orders). That would I think also make them the largest Airbus operator. I think B6 would be second, with 682 planes between A320 and A220 families.

-

- YVAMWB1900

- Posts: 113

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

Oykie wrote:This was an interesting development. I’m curious if JetBlue will move their headquarters to Florida with this merger?

Headquarters will remain in New York.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

UA444 wrote:In an ideal world, they’ll deny this one. But they won’t.

In an ideal world, a number of previous mergers would not have been allowed. This one is not a whole lot different

Re: JetBlue/Spirit Merger Discussion Thread - 2022

BlueBaller wrote:NameOmitted wrote:After what AS paid in a bidding war for VX, I'm guessing there are a few smiles in SeaTac over the $1B premium B6 paid.

Correct me if I’m wrong but ALK paid 4B in 2016 dollars compared to JBUs 3.8 in today’s.

2.6B purchase price, in 2016 dollars; 4B adjusted value including debt and leases. Adjusted for inflation, that'd be 3.22B and 4.95B respectively.

The comparable numbers for B6's NK deal are 3.8B and 7.6B. But based on fleet size, NK is almost triple the size VX was.

-

- YVAMWB1900

- Posts: 113

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

I'm sure it's going to take quite awhile to get all of NK's aircraft painted in to JetBlue's livery.

What are the odds that we are going to see some interesting Hybrid liveries between the two?

What are the odds that we are going to see some interesting Hybrid liveries between the two?

-

- SEAflyer97

- Posts: 74

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

BlueBaller wrote:NameOmitted wrote:After what AS paid in a bidding war for VX, I'm guessing there are a few smiles in SeaTac over the $1B premium B6 paid.

Correct me if I’m wrong but ALK paid 4B in 2016 dollars compared to JBUs 3.8 in today’s. Where’s the premium? Not to mention ALK is about to become extremely vulnerable due to their current network which focuses on transcons and regional strongholds, which is exactly what JetBlue is working to get away from with the acquisition.

I have to laugh at transcons.

-

- BlueBaller

- Posts: 256

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

dtremit wrote:BlueBaller wrote:NameOmitted wrote:After what AS paid in a bidding war for VX, I'm guessing there are a few smiles in SeaTac over the $1B premium B6 paid.

Correct me if I’m wrong but ALK paid 4B in 2016 dollars compared to JBUs 3.8 in today’s.

2.6B purchase price, in 2016 dollars; 4B adjusted value including debt and leases. Adjusted for inflation, that'd be 3.22B and 4.95B respectively.

The comparable numbers for B6's NK deal are 3.8B and 7.6B. But based on fleet size, NK is almost triple the size VX was.

Thank you for the clarifying point. Re-reading the previous posters point, it seems as if the “premium” referred to the 1B JetBlue paid versus what Frontier’s last and best was. Regardless, what ALK ultimately ended up with in terms of incompatible fleet, myopic network and vastly different employee culture and dynamics, I don’t see them taking on the attitude of they somehow got the better of the 2 deals. To build off your point, the size of NKs fleet, the Spirit network and carbon-copy aircraft types are factors that cannot be ignored in identifying JetBlue as a formidable threat to the likes of an Alaska Airlines.

-

- BlueBaller

- Posts: 256

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

SEAflyer97 wrote:BlueBaller wrote:NameOmitted wrote:After what AS paid in a bidding war for VX, I'm guessing there are a few smiles in SeaTac over the $1B premium B6 paid.

Correct me if I’m wrong but ALK paid 4B in 2016 dollars compared to JBUs 3.8 in today’s. Where’s the premium? Not to mention ALK is about to become extremely vulnerable due to their current network which focuses on transcons and regional strongholds, which is exactly what JetBlue is working to get away from with the acquisition.

I have to laugh at transcons.

Do they not serve:

Boston

JFK/EWR

Philly

Pittsburgh

BWI

Washington DCA/IAD

Raleigh

Atlanta

Charleston

Orlando

Tampa

Ft. Myers

Ft. Lauderdale

?

Re: JetBlue/Spirit Merger Discussion Thread - 2022

BlueBaller wrote:dtremit wrote:BlueBaller wrote:

Correct me if I’m wrong but ALK paid 4B in 2016 dollars compared to JBUs 3.8 in today’s.

2.6B purchase price, in 2016 dollars; 4B adjusted value including debt and leases. Adjusted for inflation, that'd be 3.22B and 4.95B respectively.

The comparable numbers for B6's NK deal are 3.8B and 7.6B. But based on fleet size, NK is almost triple the size VX was.

Thank you for the clarifying point. Re-reading the previous posters point, it seems as if the “premium” referred to the 1B JetBlue paid versus what Frontier’s last and best was. Regardless, what ALK ultimately ended up with in terms of incompatible fleet, myopic network and vastly different employee culture and dynamics, I don’t see them taking on the attitude of they somehow got the better of the 2 deals. To build off your point, the size of NKs fleet, the Spirit network and carbon-copy aircraft types are factors that cannot be ignored in identifying JetBlue as a formidable threat to the likes of an Alaska Airlines.

In M&A, premium is defined as transaction price vs. pre-merger closing price. Spirit closed at $12.39/share on 2/4/22, before the first Frontier (2/7/22) merger announcement. B6 is paying $33.50. There are ~109 million SAVE shares outstanding. B6 is paying a HUGE premium.

This is not priced like a bargain. NK execs and their investment bankers and lawyers earned their money by getting B6 to pay so much -- and having the security of $470 million in breakup fees/other. (I had said months ago that $500 million breakup fee would get the deal done.)

Dude, they're paying $3.8 Billion for a firm the market valued at $1.35 Billion just six months ago.

The long-term average merger premium for U.S. equities has been around 30%. B6 is paying 180%.

JetBlue said Thursday that it would pay $33.50 per share in cash for Spirit, including a prepayment of $2.50 per share in cash payable once Spirit stockholders approve the transaction. There is also a ticking fee of 10 cents per share each month starting in January 2023 through closing to compensate Spirit shareholders for any delay in winning regulatory approval.

If the deal doesn’t close due to antitrust reasons, JetBlue will pay Spirit a reverse break-up fee of $70 million and pay Spirit shareholders $400 million, minus any amounts paid to the shareholders prior to termination.

https://abcnews.go.com/Business/wireSto ... n-87538962

-

- SumChristianus

- Posts: 1045

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

The biggest "wow" for me is the projected fleet plan by 2027: 675 aircraft.

From JetBlue's presentation: https://lowfaresgreatservice.com/wp-con ... tomers.pdf

Evenif they retire A319s and get closer to something like 625, that's approaching WN numbers...

Imagine the network!

From JetBlue's presentation: https://lowfaresgreatservice.com/wp-con ... tomers.pdf

Evenif they retire A319s and get closer to something like 625, that's approaching WN numbers...

Imagine the network!

Re: JetBlue/Spirit Merger Discussion Thread - 2022

I feel like they might take the A319CEOs in the short-term for faster growth and to further accelerate the E190 retirements, leaving the fleet with only two types. I do wonder if they'll continue to order more A220s in the next few years.

Last edited by lostsound on Thu Jul 28, 2022 11:12 pm, edited 1 time in total.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

SumChristianus wrote:The biggest "wow" for me is the projected fleet plan by 2027: 675 aircraft.

From JetBlue's presentation: https://lowfaresgreatservice.com/wp-con ... tomers.pdf

Evenif they retire A319s and get closer to something like 625, that's approaching WN numbers...

Imagine the network!

Won’t WN be close to 1,000 aircraft by that point?

Re: JetBlue/Spirit Merger Discussion Thread - 2022

asteriskceo wrote:mikejepp wrote:Does anyone have a combined route map?

Dot colors represent airport size, not airline.

I wonder if Hawaii is on the horizon after the merger?

-

- jetblastdubai

- Posts: 2390

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

SumChristianus wrote:The biggest "wow" for me is the projected fleet plan by 2027: 675 aircraft.

Imagine the network!

Imagine the IRROPS recovery when 2/3s of that fleet is on the US east coast. They're biting off a whole lot to chew on. Fleet commonality is the one thing they'll have going for them.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

I feel like much of the discussion surrounding what the combined airline will look like (route map specifically) hinges on the mergers of the past--where airlines were considering what a combination of the existing airlines would look like. Do the hubs compliment each other, do the fleets compliment each other, market access, etc. I think, especially with how the last couple weeks played out, that this needs to be looked at much more like B6 just bought a whole pile of planes and associated staff to work them. I think the future route map will be much more about what B6 has wanted to do, and less about what NK does.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

MIflyer12 wrote:BlueBaller wrote:dtremit wrote:

2.6B purchase price, in 2016 dollars; 4B adjusted value including debt and leases. Adjusted for inflation, that'd be 3.22B and 4.95B respectively.

The comparable numbers for B6's NK deal are 3.8B and 7.6B. But based on fleet size, NK is almost triple the size VX was.

Thank you for the clarifying point. Re-reading the previous posters point, it seems as if the “premium” referred to the 1B JetBlue paid versus what Frontier’s last and best was. Regardless, what ALK ultimately ended up with in terms of incompatible fleet, myopic network and vastly different employee culture and dynamics, I don’t see them taking on the attitude of they somehow got the better of the 2 deals. To build off your point, the size of NKs fleet, the Spirit network and carbon-copy aircraft types are factors that cannot be ignored in identifying JetBlue as a formidable threat to the likes of an Alaska Airlines.

In M&A, premium is defined as transaction price vs. pre-merger closing price. Spirit closed at $12.39/share on 2/4/22, before the first Frontier (2/7/22) merger announcement. B6 is paying $33.50. There are ~109 million SAVE shares outstanding. B6 is paying a HUGE premium.

This is not priced like a bargain. NK execs and their investment bankers and lawyers earned their money by getting B6 to pay so much -- and having the security of $470 million in breakup fees/other. (I had said months ago that $500 million breakup fee would get the deal done.)

Dude, they're paying $3.8 Billion for a firm the market valued at $1.35 Billion just six months ago.

The long-term average merger premium for U.S. equities has been around 30%. B6 is paying 180%.

JetBlue said Thursday that it would pay $33.50 per share in cash for Spirit, including a prepayment of $2.50 per share in cash payable once Spirit stockholders approve the transaction. There is also a ticking fee of 10 cents per share each month starting in January 2023 through closing to compensate Spirit shareholders for any delay in winning regulatory approval.

If the deal doesn’t close due to antitrust reasons, JetBlue will pay Spirit a reverse break-up fee of $70 million and pay Spirit shareholders $400 million, minus any amounts paid to the shareholders prior to termination.

https://abcnews.go.com/Business/wireSto ... n-87538962

That is not correct. The closing price of SAVE on 2/4/22 was $21.73 with a market cap of $2.36 billion.

-

- BigPlaneGuy13

- Posts: 163

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

I am still trying to gather my thoughts on what antitrust regulators will make of this proposed deal and what the best positioning piece is for B6. For one, the ULCC market has plenty of new entrants that can fill the hole. Think about all those new MAX coming online in the coming years for G4. Not to mention Breeze, Avelo, and SY.

Having 5 major airlines seems like a net positive for the US consumer. And this allows B6 to go a bit more toe-to-toe with WN. What I'm curious to see play out is if they try to enter an alliance. An airline that size could use some international partners. Or will they be like WN and not have any?

Having 5 major airlines seems like a net positive for the US consumer. And this allows B6 to go a bit more toe-to-toe with WN. What I'm curious to see play out is if they try to enter an alliance. An airline that size could use some international partners. Or will they be like WN and not have any?

-

- BigPlaneGuy13

- Posts: 163

- Joined:

Re: JetBlue/Spirit Merger Discussion Thread - 2022

Another observation made in the other thread before it was shut down: what happens to the A319NEOs on order? DL makes the A220 and A319 work in their fleet. Can B6 do the same at their size?

Re: JetBlue/Spirit Merger Discussion Thread - 2022

BigPlaneGuy13 wrote:I am still trying to gather my thoughts on what antitrust regulators will make of this proposed deal and what the best positioning piece is for B6. For one, the ULCC market has plenty of new entrants that can fill the hole. Think about all those new MAX coming online in the coming years for G4. Not to mention Breeze, Avelo, and SY.

Having 5 major airlines seems like a net positive for the US consumer. And this allows B6 to go a bit more toe-to-toe with WN. What I'm curious to see play out is if they try to enter an alliance. An airline that size could use some international partners. Or will they be like WN and not have any?

B6 is already codeshare partners with the likes of EI, EK, FI, etc. If anything, this probably is going to put pressure on WN to start codesharing.

Re: JetBlue/Spirit Merger Discussion Thread - 2022

YVAMWB1900 wrote:I'm sure it's going to take quite awhile to get all of NK's aircraft painted in to JetBlue's livery.

What are the odds that we are going to see some interesting Hybrid liveries between the two?

I think the odds are Zero. Hybrid liveries really aren't a thing anymore. (They weren't in the AS/VX, WN/FL, DL/NW, UA/CO, or AA/US mergers.)

Airlines in the middle of mergers just tend to repaint the planes into the surviving carrier's livery ASAP.

Given the different products between B6 and NK, I expect that the merger will look much more like the WN/FL integration where the Southwest product never flew under the Airtran brand or vice versa. B6 remove several NK airplanes at a time to update them to the B6 product and livery, moving them over from being sold as NK flights to being sold as B6 flights. This'll take some coordination, and B6 may or may not be upto the task.

Who is online

Users browsing this forum: 13ifs40, 817Dreamliiner, A359bw, aga, AsiaTravel, Ayala, carlokiii, DanieusBR, DartHerald, F4BY, Falcon Flyer, fieldInner, Fiver, Gemuser, Google Adsense [Bot], GSP psgr, Heavierthanair, jetskipper, kalvado, kriskim, LH779, LLA001, mjgbtv, N748PA, northwest_guy, NW747, OzarkD9S, PapaD, SgtBarone, utaussiefan, VS11, wimdemeester and 250 guests